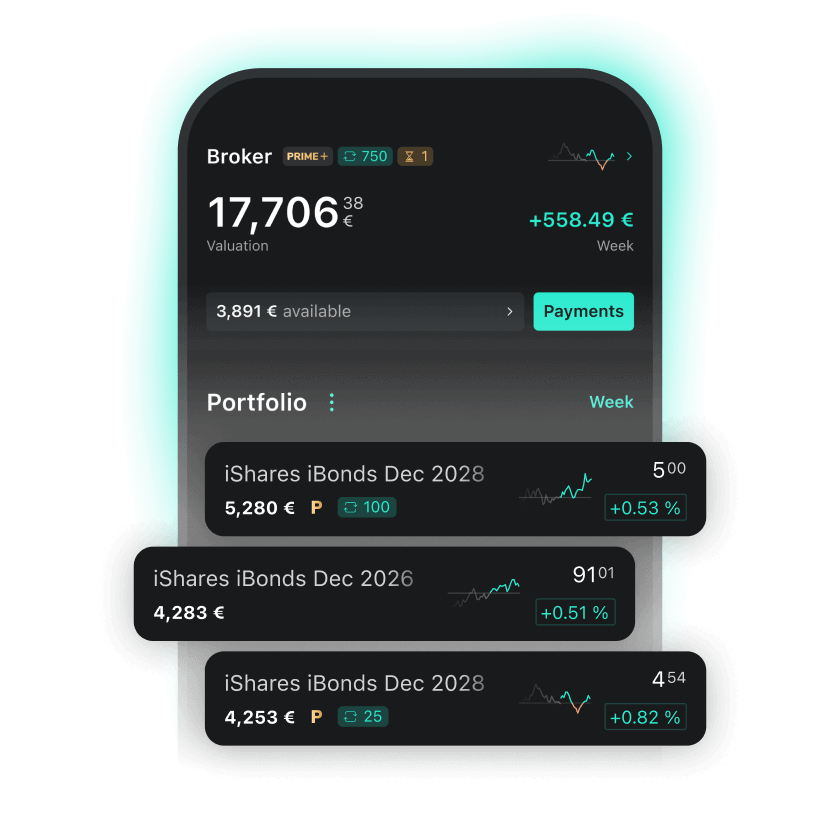

Trade iBonds ETFs

Easily invest in bonds with broad diversification

- with iBonds ETFs from iShares.

Investing involves risks.

What are iBonds ETFs?

iBonds ETFs are an innovative suite of bond ETFs that have a fixed maturity date. An iBond ETF holds a diversified basket of bonds with similar maturity dates, and distributes a final pay out at the fund’s maturity at the end of their stated maturity year.

Simple

With iBonds ETFs, you can invest in bonds in a straightforward way. With just one ETF, you invest in a broad basket of bonds from a variety of sectors and countries.

Predictable

iBonds ETFs are available in different maturities. This means that you can individually choose how long you want to invest your money and thus you are able to plan ahead at the time of the purchase.

Flexible

If your initial situation changes, you can simply buy and sell iBonds ETFs on the stock exchange at any time.

Popular iBonds ETFs in the Scalable Broker

Discover iBonds ETFs with different maturities.

iShares iBonds Dec 2026 Term €

Corp UCITS ETF

TER: 0,12 % p.a. | |

Maturity: 3 years | |

Asset class: Investment grade corporate bonds |

|

Index: Bloomberg MSCI December 2026 Maturity Euro Corporate ESG Screened Index |

Buy now | Learn more

Not a customer yet? Open an account

iShares iBonds Dec 2028 Term €

Corp UCITS ETF

TER: 0,12 % p.a. | |

Maturity: 5 years | |

Asset class: Investment grade corporate bonds |

|

Index: Bloomberg MSCI December 2028 Maturity Euro Corporate ESG Screened Index |

Buy now | Learn more

Not a customer yet? Open an account

iShares iBonds Dec 2025 Term € Corp UCITS ETF | IE000GUOATN7

- Asset class: Euro Corporate Bonds

- Maturity: 2 years

- Accumulating

iShares iBonds Dec 2025 Term $ Treasury UCITS ETF | IE000U99N3V1

- Asset class: US Dollar Corporate Bonds

- Maturity: 2 years

- Accumulating

iShares iBonds Dec 2026 Term $ Corp UCITS ETF | IE0007UPSEA3

- Asset class: US Dollar Corporate Bonds

- Maturity: 3 years

- Distributing

iShares iBonds Dec 2026 Term $ Corp UCITS ETF | IE000BWITBP9

- Asset class: US Dollar Corporate Bonds

- Maturity: 3 years

- Accumulating

iShares iBonds Dec 2026 Term € Corp UCITS ETF | IE000SIZJ2B2

- Asset class: Euro Corporate Bonds

- Maturity: 3 years

- Distributing

iShares iBonds Dec 2027 Term $ Corp UCITS ETF | IE000I1D7D10

- Asset class: US Dollar Corporate Bonds

- Maturity: 4 years

- Accumulating

iShares iBonds Dec 2027 Term € Corp UCITS ETF | IE000ZOI8OK5

- Asset class: Euro Corporate Bonds

- Maturity: 4 years

- Accumulating

iShares iBonds Dec 2028 Term $ Corp UCITS ETF | IE0000UJ3480

- Asset class: US Dollar Corporate Bonds

- Maturity: 5 years

- Accumulating

iShares iBonds Dec 2028 Term $ Corp UCITS ETF | IE0000VITHT2

- Asset class: US Dollar Corporate Bonds

- Maturity: 5 years

- Distributing

iShares iBonds Dec 2028 Term € Corp UCITS ETF | IE000264WWY0

- Asset class: Euro Corporate Bonds

- Maturity: 5 years

- Distributing

iShares iBonds Dec 2026 Term € Italy Govt Bond UCITS ETF | IE000LZ7BZW8

- TER: 0.12% p.a.

- Asset class: Government bonds

- Maturity: 2 years

- Index: ICE 2026 Maturity Italy UCITS Index

iShares iBonds Dec 2028 Term € Italy Govt Bond UCITS ETF | IE000Q2EQ5K8

- TER: 0.12% p.a.

- Asset class: Government bonds Italy

- Maturity: 4 years

- Index: ICE 2028 Maturity Italy UCITS Index

Differences to other bond products

iBonds |

Bond ETFs |

Single bonds |

Funds |

|

|---|---|---|---|---|

Fixed maturity |

|

|

|

|

Broad diversification |

|

|

|

|

Product costs (TER) |

0.12% p.a. |

Depending on the ETF (usually between 0.1 and 0.5% p.a.) |

− |

Depending on fund (usually |

Fixed maturity date provides certainty in planning

Bond ETFs usually don't have a maturity date. The bonds held in the ETFs are bought and sold. When a bond matures, the redemption is invested in a new bond. Therefore, it is not certain when investors will get back the face value of their initial investment. iBonds ETFs, however, have a fixed maturity date. Thus, you know from the very beginning when your invested money will be repaid.

Low-cost investment with broad diversification

iBonds ETFs track an entire index. So with just one iBonds ETF, you invest in a range of bonds, covering multiple sectors and countries. To achieve such broad diversification with individual bonds, you would have to buy several dozens of individual bonds.

Frequently asked questions

- How do I know the maturity of an iBonds ETF?

The maturity always ends in December of a given year. Which year it is can be easily identified in the name of the respective product. - Can I set up savings plans for iBonds ETFs?

Yes, iBonds ETFs are available for savings plans like all other ETFs in the Scalable Broker starting from €1 savings rate. - How much does it cost to trade iBonds ETFs in the Scalable Broker?

iBonds ETFs can be bought in the Scalable Broker without any order fees - starting from an order volume of €250. Savings plans are commission-free. The concrete costs depend on the selected pricing model and the order volume:PRIME+ Broker: €0 for trades of €250 or more, otherwise €0.99.

FREE Broker: €0 for purchases of PRIME ETFs (all Invesco, iShares, Xtrackers ETFs) of €250 or more, otherwise €0.99.

All brokerage models: €0 for savings plan executions.

Product costs, spreads and/or inducements may apply. Learn more. - Does it make a difference at what time I invest in the products?

Yes. When and at what price you invest will influence your expected return.